Browse Delaware Communities

For Events, Why We Live Here Series, What Sold, Company Updates and more . . .

Sold Properties in July 2018

Home Sales in Southern Delaware

Land Sales in Southern Delaware

Info. from the Sussex County Association of Realtors MLS

Just For Fun . . .

Monthly Trivia

A. What is the first organism to grow back after fire?

B. Pro golfers rack up points as they compete for what corporate-sponsored cup that was first awarded in 2007?

C. Who ended his final 60 Minutes segment by saying “if you do see me in a restaurant, please, just let me eat my dinner”?

Why We Live Here . . .

A Popular Photographic Series provided weekly on our blog at SellingDelawareHomes highlighting attractions, history and interesting places here in the beach area of Southern Delaware.

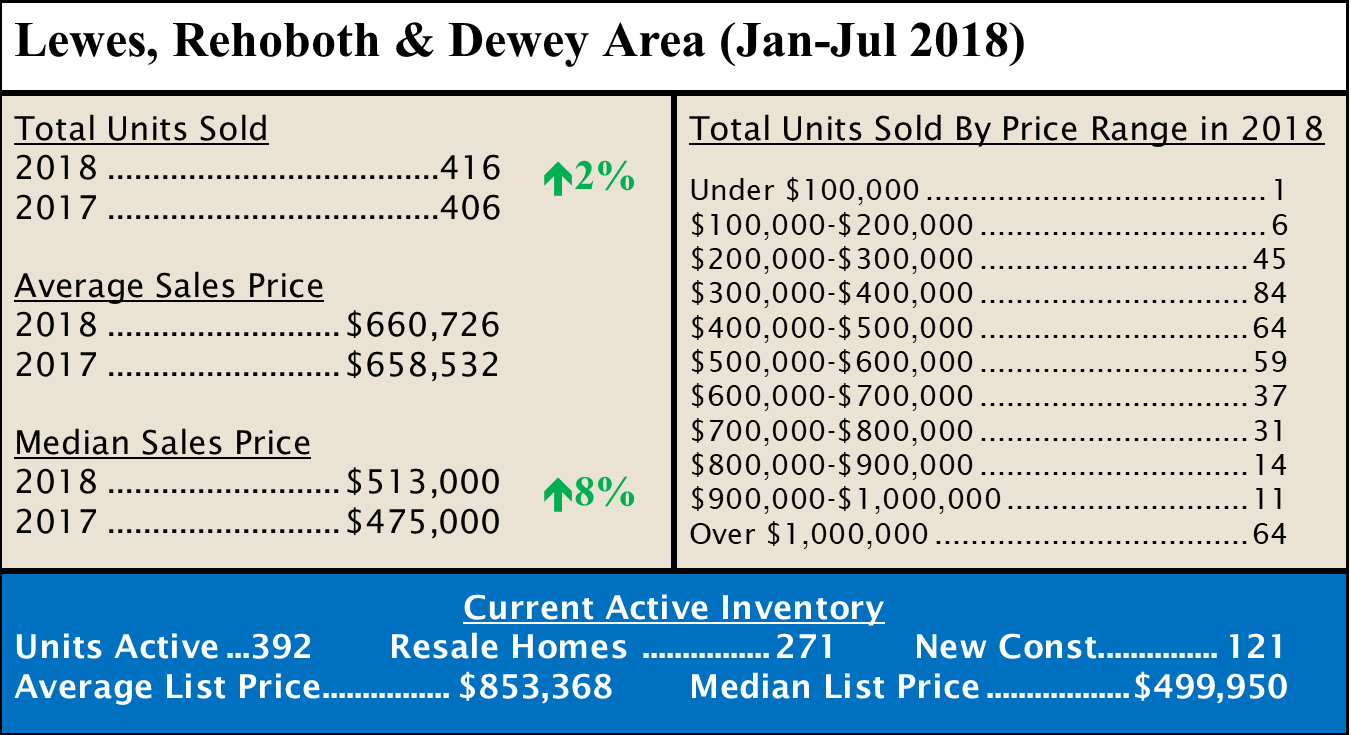

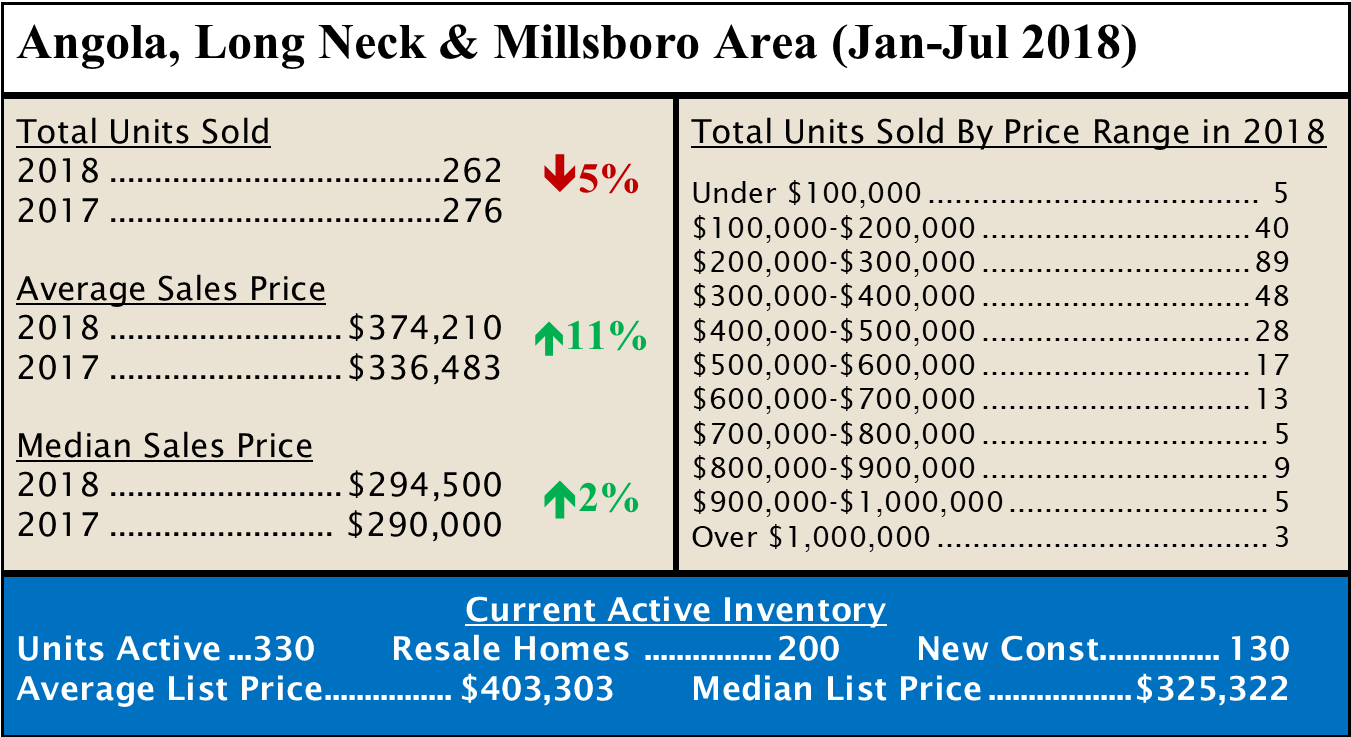

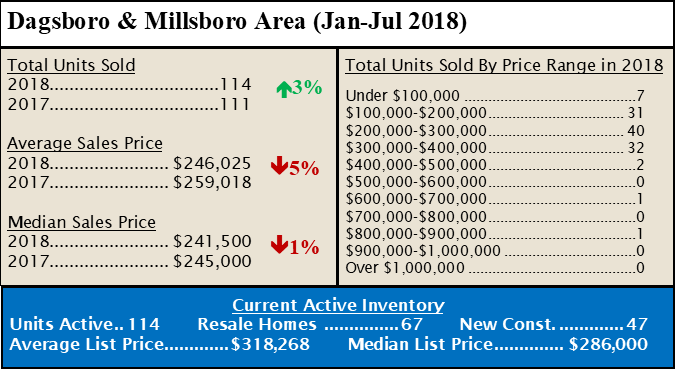

Market Activity for July:

As of the end of July, there were a total of 2,098 homes on the market, a decrease of 2% from the previous month’s end inventory of 2,147. This represents a 7-month’s supply of inventory, with a current absorption rate of 297 homes sold per month thus far in 2018. Of the total inventory, 34% (713 homes) of the homes available are new construction.

Closed Sales

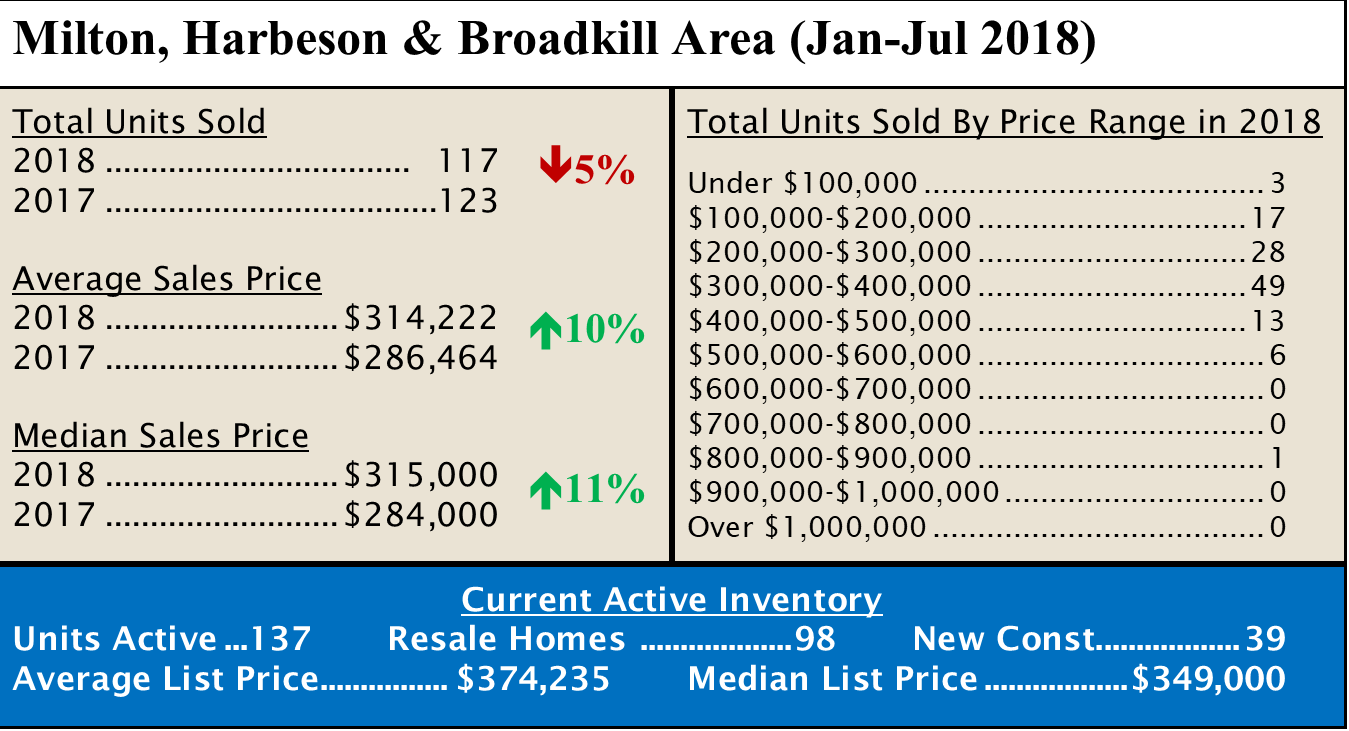

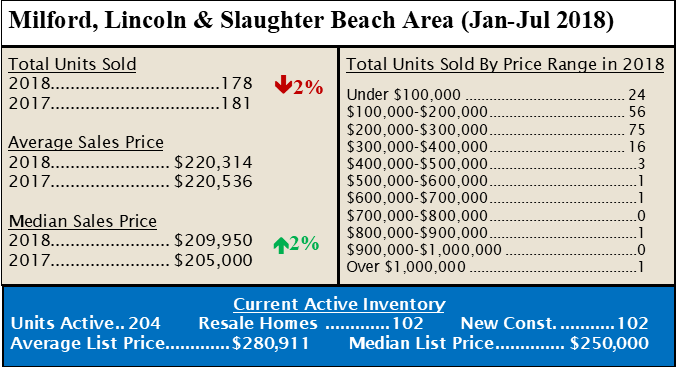

For the first seven months of 2018, sales of single-family homes in Sussex County are up 2% from last year, with 2,062 homes sold compared to 2,028 for the first seven months of 2017. The areas with the largest increase were the Georgetown Area, up 15% and the Bethany/Ocean View/Fenwick Area, up 14%. The areas with the largest decrease are Western Sussex County, down 6%, and the Angola/Long Neck/Millsboro Area, down 5% from last year to date.

Too many Clothes, No Down Payment

Crazy fashion trends do more than strain closet space. They can sometimes send the message that trendiness is more important than building wealth. Here’s to save the money you spend on new clothes for something more rewarding – a down payment on your own home.

Reduce your wardrobe. Consign, donate or give away clothes you haven’t worn in a year or two. Keep anything that goes with at least three other items, like a jacket that works with a dress, skirt and blouse, or jeans.

Take better care. Fast fashion doesn’t last, so when you wash clothes, turn pants, skirts and blouses inside out first. Don’t use wire hangers. Fold knits instead of hanging them. Your clothes will look better and last longer.

Buy less. If you buy something for $100, look at how long the season is to wear it (four months) and how many times you’ll actually wear it (17). Take the cost ($100) and divide by the number of wearings. That’s a tax of $5.88 every time you wear it.

Bank the money. If you spend $200 a month on clothes, try a year without buying anything new and let that $200 multiply in a savings account, 401K, or CD. That’s $2,400 that could grow with compound interest and investment growth. In three years, you could have over $10,000 or more and that’s a good start toward owning a home.